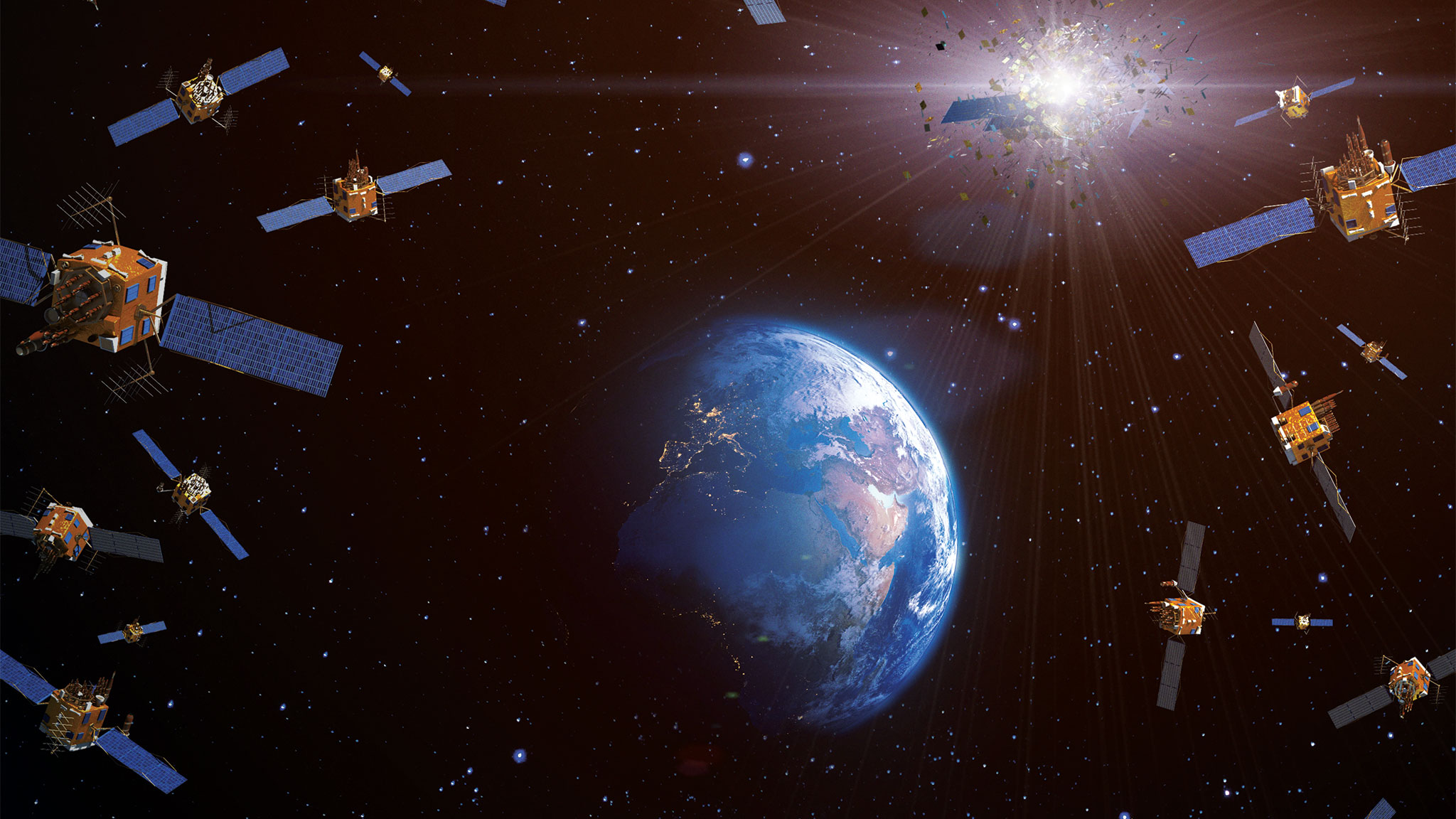

Pic Courtesy: Internet

Ritu Sharma is a journalist, with a Master’s Degree in Conflict Studies and Management of Peace from the University of Erfurt, Germany. Her areas of interest include Asia-Pacific, the South China Sea, and Aviation history. She has been writing on subjects related to defence, foreign affairs, and nuclear technology for the last 15 years. She has written for PTI, IANS and The New Indian Express. Presently she is writing for the EurAsian Times.

Her informative article on the subject was published on 13 Jan 2024 on “The EurAsian Times”

(Views of the author are her own)

‘Stolen Tech’ From F-35 & F-22 Raptor, How Powerful IsChina’s Newest FC-31 Gyrfalcon Stealth Jet?

The news about Pakistan showing interest in the Chinese FC-31 Gyrfalcon (formerly known as the J-31) has generated quite a buzz in South Asia, with military watchers talking about it altering the balance of power in the Indian subcontinent. But experts feel that, at best, it is a tempest in a teacup.

The grapevine about Pakistan’s interest in purchasing FC-31 has been going on for some time. However, the Islamic Republic’s lack of economic resources and choices to replace its ageing fleet of F-16s and Mirages make the Chinese fighter jet its only option. Its JF-17 fleet is also facing technical issues. The FC-31 is yet to enter the PLA-Air Force but the Pakistan Air Force has made its interest official.

Air Marshal Anil Khosla (retired), former Vice Chief of the Indian Air Force, calls it “a marriage of convenience”. The sale to Pakistan will help China to claim the exportability of its aircraft. The aircraft with PAF will provide the Chinese manufacturer with a free trial ground. At the same time, it will help Beijing in exerting more control over Islamabad by making them more dependent,” Khosla told the EurAsian Times.

The EurAsian Times decided to compare Indian Rafale – a 4.5 generation combat-proven fighter jet from the French aerospace maker Dassault Aviation; and FC-31 – the underdevelopment 5th generation fighter jet developed by the Shenyang Aircraft Corporation. On the face of it, both aircraft are twin-engine, single-cockpit, multi-role fighter jets.

Design & Capabilities: Rafale Vs J-31

The design philosophy behind Dassault’s Rafale (meaning ‘Gust of Wind’) has been to pack more punch in the fighter jet. The Rafale is one of the most advanced fighter jets of the present times and is designed to carry out omni-role missions. It can perform seven types of missions – Air-defence/air superiority/air policing, Reconnaissance, nuclear deterrence, Air-to-ground precision strike, Battlefield air strikes, anti-ship attacks, and buddy-buddy refuelling.

The French fighter jet features a delta wing with close-coupled canards that provide stability throughout the whole flight envelope. It improves Rafale’s combat performance, even at a high angle of attack.

The airframe of Rafale extensively uses composite materials; they account for 70 per cent of the wetted area. This increases the max take-off weight to empty weight ratio compared with traditional airframes built of aluminum and titanium by 40 percent.

On the other hand, the limited information about the FC-31 indicates that it was designed to provide close support and air-to-ground bombing. Its design also suggests that it might have been designed for carrier use.

Many observers have noted the stark resemblance that the FC-31 has with the American F-35. The flat tail and twin engines of FC-31 seem to be derived from the F-22, and the front end resembles the F-35. This doesn’t come as a surprise as the 2014 “U.S.-China Economic and Security Review Commission” Congressional report cited a Defence Science Board finding that Chinese cyber-attacks have siphoned off crucial specs and technical details of a range of US weapons systems—including the F-35.

The Chinese composite material industry had a late start. Russia helped for some time, but sanctions have slowed the import of Radar Absorbent Material (RAM).

The J-31 uses 3D laser-printed components in large amounts to save weight. The J-31 features advanced stealth technology, including a carefully designed shape and radar-absorbent materials, to reduce its radar cross-section and enhance survivability on the battlefield.

Rafale Vs J-31: Engines

When it comes to engines, Rafale is powered by two Snecma M882 (Thrust to Weight Ratio: 5.68:1 dry and8.52:1 with afterburner) new generation turbofan engines generating 2×75 kN of thrust and can achieve a maximum speed of Mach 1.8.

Besides ensuring a high serviceability rate, Dassault Aviation made some India-specific modifications to the 4.5-generation fighter jets. The modifications included an engine that can start up to 12000 feet. The specification caters to the threat India faces on its eastern border.

Within a few months of its induction, the IAF had Rafale fighter jets armed with MICA air-to-air missiles on their wingtips flying in Ladakh, its northernmost sector. Post heightened tension along the Indo-China border, India has been augmenting its capabilities to operate in the region.

In contrast, the FC-31 prototype was powered by two Russian engines, RD-93, with an afterburning thrust of2×81 kN (Thrust to weight ratio: 4.82 dry, 7.9 afterburning). The engine’s thrust-to-weight ratio indicates that the FC-31s engine is heavier and provides lesser thrust as compared to Rafale’s lighter engines.

The engines could be the chink in FC-31’s armour. After some time, Shenyang Aircraft Corporation replaced the RD-93 turbofans with new stealthy engines WS-13 from Guizhou Aircraft Industry Corporation. Beijing has offered the same engine for the technically troubled JF-17 exported to the Pakistan Air Force (PAF), but Pakistan has refused.

“The Chinese are trying hard to market their WS-13 engine. I am not sure if the engine is any good. But, PAF had refused to accept it for their JF-17s. Now, with J-31 as a sweetener, the WS-13 is going to find its way into PAF. Eventually, it might also find its way into PAF JF-17s,” a source told the EurAsian Times.

There have been reports about the aircraft finally being fitted by the more modern WS-19 engines currently under development.

Rafale Vs J-31: Armament

With its 10-tonne empty weight, the Rafale is fitted with 14 hard points (13 on the Rafale M). Five of them are capable of carrying heavy ordnance or drop tanks. The total external load capacity is more than nine tonnes (20,000 lbs.).

The Rafale has been cleared to operate a wide range of weapons, including air-to-air missiles, air-to-ground missiles, bombs, and guns. The Indian Rafales can deploy the Meteor very long-range air-to-air missile, the MICA air-to-air “Beyond Visual Range” (BVR) interception, the HAMMER rocket boosted air-to-ground precision-guided weapon, the SCALP long-range stand-off missile, laser-guided bombs, and classic non-guided bombs. The fighter jet has a 30 mm internal cannon that can fire 2500 rounds/min. Meteor gives Indian Rafales the capability to shoot down enemy aircraft over 100 kilometres without having to cross the border. Rafales are going to be part of India’s nuclear triad when Brahmos integrates with the platform.

In comparison, the Shenyang FC-31 stealth fighter can be fitted with one internal cannon, two internal weapons bays in the fuselage, and three payload hard points on each of the two wings. Each internal weapons bay can accommodate up to two missiles. The FC-31 could carry larger missiles like the YJ-12 anti-ship missile under its wings, but like with the F-35, at the cost of its stealth.

FC-31Avionics Onboard

The Rafale is the first European combat aircraft to use an active electronic scanning radar, giving it greater situational awareness in detecting and tracking multiple targets.

Rafale’s “multi-sensor data fusion” has earned accolades for reducing pilot workload and increasing situational awareness within and outside the boundaries of the combat sphere. Rafale allows the pilot to act as a true“tactical decision maker” rather than being only a sensor operator.

The Indian Rafales are equipped with the Thales Areos recon pod, which can be used from a high-altitude stand-off distance and even at extremely low levels. But it is also integrated with Israeli Litening Pod to maintain commonality with other fighter jets in IAF, such as Mirage-2000, Su-30 MKI, MiG-29 UPG, and SPECAT Jaguar.

The single-seated cockpit of the Shenyang FC-31 is confined by a two-piece transparent canopy to enhance the pilot’s visibility during flight. It is also designed to use the KLJ-7A Active Electronically Scanned Array (AESA)radar by Nanjing Research Institute of Electronics Technology (NRIET) and Distributed Aperture System (DAS)optical early warning system.

Stealth

The FC-31 is essentially designed with increased stealth features. The Indian Rafale F3R boasts Spectra and a low-band jammer that can jam the frequency of any radar and become invisible. “It is a dichotomy. The Rafale can jam the radars to become invisible, but if the moment a stealth aircraft uses its jammer, he will be caught on the adversary’s sensors,” another military aviation specialist opined.

The French aircraft maker also catered to the Indian demand for a different Jammer and enhanced radar capabilities like Non-Cooperative Target Recognition (NCTR) mode, Doppler Beam Sharpening, and synthetic aperture Radar modes in Radar. It also has Ground Moving Target Track modes in the Radar.

The Indian Rafale also has the Infrared Search and Track (IRST) sensor that differentiates it from its French counterpart. The IRST gives an edge to Rafale to detect and track airborne targets and the sensor can be used in conjunction with the radar or independently. This is a passive system and doesn’t emit any radiation of its own. It gives Rafale the capability to detect other targets while remaining undetected.

Combat Development

The first Rafale F1 was delivered to the French Navy exactly a decade later, on May 18, 2001. Since then, France has deployed this combat jet in Afghanistan, Libya, Iraq, Syria, and Mali, where it flew its longest mission in 2013, spanning nine hours and 35 minutes. From Afghanistan, Libya, Mali, Iraq, and Syria, Rafale jets “outclassed” its enemies everywhere and have never-ever been shot down.

In 2011, French Air and Space Force and French Navy Rafale fighters were successfully engaged in coalition operations over Libya. They were the first fighters to operate over Benghazi and Tripoli. During the Libyan conflict, hundreds of targets – tanks, armoured vehicles, artillery emplacements, storage dumps, command centres, and air defence systems (fixed and mobile SAM launchers) – were hit with controlled accuracy by Rafale aircrews.

This column is still blank for FC-31 and probably the sale to PAF will help the Chinese aerospace makers to script a few achievements under this head.

Conclusion

In the words of Air Marshal Khosla, “Should India take cognizance of the development in the neighbourhood –Yes. Should India be worried – No. Instead, India should address the issue.” The retired Vice-Chief of the IAF doesn’t advise diversifying the already diverse inventory of the force to meet the challenge; he suggests accelerating indigenous projects like Tejas Mk2 and Advanced Multi-role Combat Aircraft (AMCA). Also, the IAF could go in for two more squadrons of already tested, selected, and inducted Rafale aircraft.

Suggestions and value additions are most welcome

For regular updates, please register here:-

References and credits

To all the online sites and channels.

Disclaimer:

Information and data included in the blog are for educational & non-commercial purposes only and have been carefully adapted, excerpted, or edited from sources deemed reliable and accurate. All copyrighted material belongs to respective owners and is provided only for purposes of wider dissemination.