BUDGET AT A GLANCE

2023-2024

(Click on the link above)

Key Features of

Budget 2023-2024

(Click on the link above)

Personal Income Tax Announcements Budget 2023

- People earning up to 7 lakh will not have to pay any tax under new tax regime

- New tax regime slabs reduced to 5

- Standard Deduction 52.5k in new tax regime

- Highest surcharge rate from 37% to 25%

- New Tax Regime default

- Senior Citizens Savings Scheme increased from 15 lacs to 30 lacs

- MIS Increased from 4.5 lacs to 9 lacs Single Account & 9 lacs to 15 lacs for Joint Account

Defence Budget

- No announcements on the defence budget in speech. Probably not significant enough or learning from China (Keep people guessing)

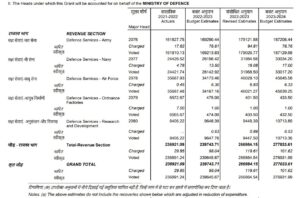

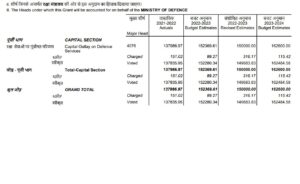

Defence Budget:

India’s defence budget tabbed at Rs 5.94 lakh cr for FY 2023-24 Capital outlay : 1.62 lakh crore (1.50lcr last yr) hiked by Rs 10,000 cr Pensions: 1.38 lakh cr (1.19 lakh crore last year.)

Capital increased from 1.52 to 1.62 lac Cr

Army from 32000 to 37,000

Navy from 47,700 to 52,800

AF from 55,500 to 57,000

Budget for Pensions increased from Rs 1.19 to 1.38 lac Crs

Budget snapshots:

- Per capita income at ₹1.97 lac more than double in last 5 years.

- India 5th largest economy of the world.

- Digital payments of 126 lac crores in 2022.

- 11.7 crore toilets. 9.64 crore cylinders. 220 crore Covid doses.

- 2.2 lac crores direct Trf to farmers

- Huge impetus on tourism. State and centre aligned and public private partnership programmes

- Green economy to be pushed beyond realms. Carbon footprint reduction roadmap

- Government to support agri tech startup’s. Agricultural accelerator fund to be set up

- Public private partnership allowed in cotton manufacturing

- India to become global hub for millets. India is largest producer and second largest exporter of all kinds of millets.

- Indian institute of millet research will be made international

- Agricultural credit target to be made till 20 lac crore with support to dairy.

- ₹2200 crores for horticulture

- Agricultural societies, dairy and fishery societies to be set up

- 157 new nursing colleges to be set up

- National book trust and children book trust to be revamped. New non curriculum books in regional Languages to be added.

- ₹6000 allocated to fisheries

- PMPVTG to be launched. Tribal areas to be developed. Education, infra, telecom, and sustainable livelihood to be developed. ₹15000 crores

- PMAVAS to be increased to ₹79000 crores. Increase of 66%

- Capital investment outlay increased to ₹10 lac crores. Increase of 33%. Approx 3.3% of GDP

- Effective Capex to be ₹13.7 lac crores. Approx 4.5% of GDP

- 50 additional AirPort to be revived for better connectivity.

- Railway outlay ₹2.4 lac crore. 9 times the budget of 2013-14

- Urban development infra fund to be started. Managed by NHB

- Septic tanks in city and towns to be changed. Manhole to machine holes

- Jan Vishwas bill to normalise laws.

- Centre of excellence for artificial intelligence. Three labs to be set up with private help in top institutes of the country.

- National data governance policy to be brought out.

- Vivad se Vishwas 2 launched. For contractual disputes. Voluntary settlement scheme.

- E-courts phase 3 launched

- Digi lockers to be made universally available

- ₹7000 crores for phase 3 of e-courts

- Lab grown diamonds to be emphasised.

- 100 labs for 5G development

- Focus on green growth. National green hydrogen ₹19700 crores allocation

- ₹35000 crores in energy TRANSITION

- Green hydrogen production to be made till 5MMT TILL 2030

- Renewal energy allocated ₹20700 crores

- Mangrove plantation along coastline wherever feasible.

- 1 crore farmers to be trained for natural farming.

- 3000 legal provisions decriminalised

- 36 skill international setups to be made

- Tourism made easy. Every destination to be made full package.

- Dekho apna Desh to be launched. Swadesh Darshan launched. Domestic tourism against international tourism promoted.

- ₹9000 fresh allocation to credit guarantee scheme

- Data embassies at IFSC GIFT

- Fresh IEPF only portal

- Digital public infrastructure to get proper help

- Mahina samman bachat Patra one time new small saving scheme for 2 years till March 2025. Deposit facility till 2 lac at fixed interest rate of 7.5%

- Max deposit limit for senior citizen FD scheme enhanced to ₹30 lacs

- Entire 50 year loans to state to be spent on infra Capex. Mandatorily to be spent. Scrapping old govt vehicles.

- Fiscal deficit of states to be 3.5% of GSDP

- 2022-23 revised estimates are 24.3 lac crores (20.9 are tax receipts)

- Fiscal deficit at 6.4%.

- 2023-24 incoming 27.25 lc crores and expense at 45 lac crores.

- Fiscal deficit 2023-24 5.9%

- Fiscal deficit target of below 4.5% by 2025-26

- Gst paid compressed biogas to be duty free.

- Except agri custom duty reduced to 13% from 21%

- 31 crore unit produced in india in 2022. Relief of custom duty on import of certain parts like cam are lens

- Manufacture of tv on parts of cells, custom duty now be 2.5%

- BCD on electric chimney 7.5 to 15% and on heat coil to be 15% from 20

- Deethyl alchohol on BCD reduced to 2.5%

- Marine products- shrimp feed duty reduced.

- BCD on seeds of lab grown diamond reduced.

- Exemption in bcd of some products of input of iron n steel reduced or removed.

- Some cigarette to be costlier by 16%

- 72 lac returns filed on a single day.

- Processing days of ITR reduced from 93 days to 16 days.

- 44AD and 44ADA are now at 3 crores and 75 lacs.

- Gst exempted for blending of CNG

- 16% fresh NCCD om cigarette

- Primary agricultural society can deposit cash up to 2 lac.

- Income tax benefit and c/o losses till 10 years of incorporation

- Deploy 100 joint commissioners to get cases disposed.

- Income tax- rebate increased limit to 7 lacs in the new tax regime

- New income tax slab will have only 5 slabs. 0-3 nil. 3-6 5%. 6-9 10%

- Standard deduction under new tax regime to be 52500 for salary up to 15.5 lac

- Highest tax rate is 42.7%. Now reduced. Surcharge now at 25% from 37%. New tax now at 39%

- Leave encashment now at 25 lac

- New income tax regime is now the default setting.

- Revenue of 38000 crores will be foregone by tax consolidation.

Analysis Follows

Suggestions and value additions are most welcome

For regular updates, please register here

References and credits

To all the online sites and channels.

Disclaimer:

Information and data included in the blog are for educational & non-commercial purposes only and have been carefully adapted, excerpted, or edited from sources deemed reliable and accurate. All copyrighted material belongs to respective owners and is provided only for purposes of wider dissemination.

Thanks