1a: What’s the historical legacy of the trans-border Rivers between India and China?

-

- The trans-border rivers between India and China, most notably the Brahmaputra (Yarlung Tsangpo in Tibet), the Indus, and the Sutlej, have long played a crucial role in shaping the historical and contemporary relationship between the two countries.

- Their legacy is deeply intertwined with colonial-era geopolitics, water resource competition, and the evolving strategic tensions between India and China.

- The Brahmaputra, Indus, and Sutlej rivers originate in Tibet, historically having fluid sovereignty claims before its integration into China in 1950.

- British India recognised Tibet as an autonomous region, but the Chinese annexation of Tibet significantly altered the strategic importance of these rivers.

- The British Raj was concerned about Chinese influence over the water sources and actively sought treaties and diplomatic manoeuvres (e.g., the 1914 Simla Accord, which China never fully recognised) to define border arrangements.

- Despite British concerns, pre-1947 did not see active contestation over river resources since China lacked the technological and economic capability to alter water flows significantly.

- After India’s independence and China’s annexation of Tibet (1950), both countries engaged in limited cooperation on water sharing.

- However, the deterioration of relations in the 1950s, culminating in the 1962 Sino-Indian War, disrupted diplomatic communication on river management.

- Unlike India and Pakistan (who signed the Indus Waters Treaty in 1960), China never agreed to a formal water-sharing agreement with India.

- 1b: How does this legacy play in contemporary relations?

- The legacy of these rivers plays a significant role in modern geo-strategic, economic, and environmental disputes between India and China.

- China controls the headwaters of major rivers flowing into India but has no legally binding treaty on water sharing with India.

- This gives China an asymmetrical advantage over India, raising fears of diversifying and strategically manipulating river flows.

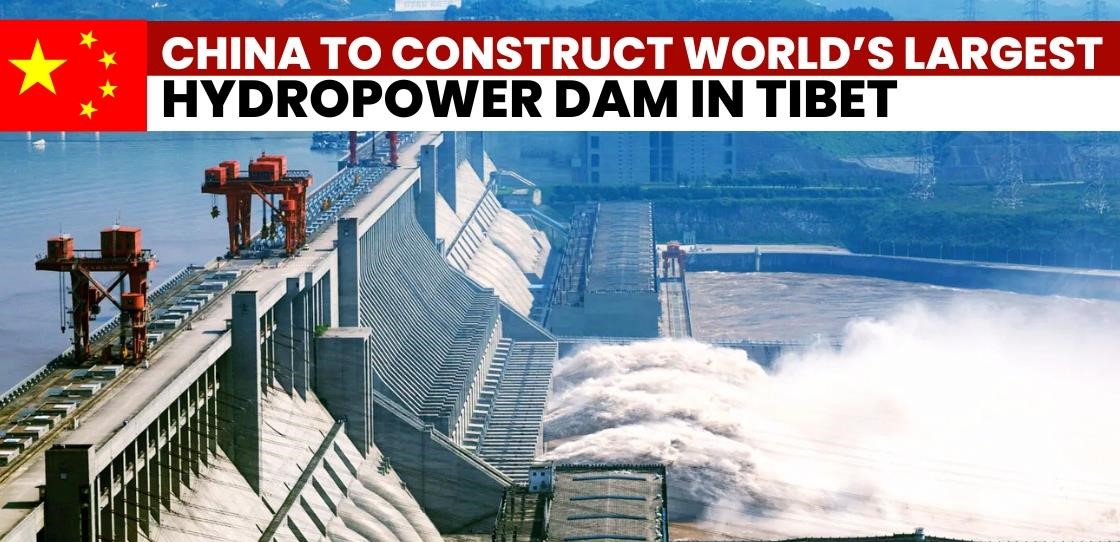

- China has constructed multiple dams on the Yarlung Tsangpo (Brahmaputra), including the Zangmu Dam, and plans a mega-dam at the Great Bend near Arunachal Pradesh.

- India fears that Chinese upstream dams could reduce water flow, especially during dry seasons, affecting agriculture, livelihoods, and ecosystems in Assam and Arunachal Pradesh.

- China officially states that these projects are run-of-the-river and do not significantly alter flows, but India remains wary.

- In the event of a military conflict, India fears that China could weaponise water by artificially creating floods or droughts.

- China has, at times, withheld hydrological data from India during monsoon seasons (e.g., in 2017 during the Doklam standoff), exacerbating flood risks in the northeastern states.

- Existing mechanisms, such as the annual hydrological data-sharing agreement, are limited in scope and do not address more significant concerns over dam-building and strategic manipulation of river flows.

- The historical legacy of colonial geopolitics and the asymmetry of water control continue to shape contemporary Sino-Indian relations, making trans-border rivers a critical flashpoint in their evolving rivalry.

2: How do dams today define and complicate the disputed border management between India and China?

-

-

- Dams have become critical in the complex and disputed border management between India and China, influencing water security and strategic, military, and geopolitical dynamics.

- These dam projects, primarily on trans-border rivers such as the Brahmaputra (Yarlung Tsangpo) and the Sutlej, intersect with the broader territorial disputes along the Line of Actual Control (LAC), exacerbating tensions.

- Dams along the Sino-Indian border are not just hydropower and irrigation projects; they serve as strategic assets with potential military and geopolitical consequences.

- China controls the headwaters of major rivers flowing into India, including the Brahmaputra and the Sutlej. This upstream control allows Beijing to dictate the volume and timing of water flow.

- China’s ability to divert, manipulate, or withhold water during crises or conflicts gives it a non-conventional weapon against India.

- During the 2017 Doklam standoff, China withheld hydrological data on the Brahmaputra, flooding Assam and reinforcing Indian fears of water weaponisation.

- Any large-scale water diversion could create flashpoints for diplomatic and military escalation.

- Dams near the disputed borders have also created security risks and military vulnerabilities. If targeted in a military conflict, these could lead to environmental and humanitarian disasters.

- Dams are no longer economic or energy infrastructure; they are now geo-strategic tools shaping the border dispute.

-

3: Are there any particular dams by China that threaten India?

-

-

- Several Chinese dam projects on trans-border rivers, particularly the Brahmaputra (Yarlung Tsangpo) and Sutlej rivers, pose potential threats to India.

- The Great Bend Mega-Dam, a massive hydropower project, is planned at the Great Bend of the Yarlung Tsangpo, near where the river turns into the Brahmaputra and enters India. This project could be one of the largest hydropower plants in the world, with a capacity of 60 GW, nearly three times the size of the Three Gorges Dam. India fears the dam could reduce water flow into Arunachal Pradesh, impacting agriculture and drinking water supply. China could suddenly release excess water, leading to catastrophic floods in Assam and Arunachal Pradesh. The project is close to the disputed Arunachal Pradesh border, reinforcing China’s territorial claims over the region. India has raised strong diplomatic objections, but China has refused to provide assurances that it will not alter natural water flows.

- China’s Zangmu Dam (510 MW), commissioned in 2015, is the first large-scale hydropower project on the Yarlung Tsangpo. It is part of a cascade of six dams, including Jiexu, Jiacha, and Dagu, which China is building upstream of Arunachal Pradesh. While officially a run-of-the-river dam, multiple reservoirs upstream could be used to control water release. China could store water in the dam during monsoons and release it suddenly, causing flash floods downstream in India.

- Dagu, Jiexu, and Jiacha Dams. These three dams, built in succession along the Brahmaputra’s upper reaches, further increase China’s capacity to regulate and potentially divert the river’s flow before reaching India. The combined effect of multiple dams allows Beijing to control water release precisely, creating a hydrological choke point for India. These projects could permanently reduce water flow into India, especially in dry seasons.

- Lalho Dam, completed in 2019, is built on a major tributary of the Yarlung Tsangpo, holding back over 295 million cubic meters of water. While it is not on the main course of the Brahmaputra, its operation reduces tributary inflow into the river. Less water reaching the Brahmaputra in Tibet means lower flow into Arunachal Pradesh and Assam. This dam is part of China’s broader plan to harness Tibetan water resources, raising fears of future large-scale diversions.

- Proposed North-to-South Water Diversion Project (Long-Term Threat). China has long debated a massive water diversion project to transfer water from Tibet to its arid northern regions. If implemented, this project could significantly alter the flow of the Brahmaputra before it even reaches India.

- China is also building smaller-scale hydropower projects on the Sutlej River (which flows from Tibet into Himachal Pradesh). These dams have not been widely publicised, but they could potentially affect seasonal water flow into India’s northern regions.

-

4 Are any specific Indian states more threatened by the Chinese dams on the border?

-

-

- Several Indian states are particularly vulnerable to the impact of Chinese dams on trans-border rivers, with Arunachal Pradesh and Assam facing the highest risks.

- Arunachal Pradesh is most directly threatened. It shares a long border with Tibet, and the Brahmaputra (Yarlung Tsangpo) enters India here. China’s Great Bend Mega-Dam and Zangmu Dam could alter or reduce water flow into Arunachal Pradesh. Sudden water releases from Chinese dams could flood Indian villages, disrupt agriculture, and damage infrastructure.

- Assam faces severe economic and ecological Threats. The Brahmaputra enters Assam from Arunachal Pradesh and is vital to the state’s agriculture, fishing industry, and transportation. Assam has a history of devastating floods, and any Chinese dam activity upstream could worsen the situation. Assam faces catastrophic flooding if China releases excess water (as suspected in the 2000 and 2017 floods). If China holds back water, it could impact agriculture, drinking water, and hydropower production. The Brahmaputra, including the Majuli River Island and Kaziranga National Park, supports a rich ecosystem. Flow changes could harm biodiversity and fisheries. Reduced or erratic water flow threatens rice farming and fishing-dependent communities. Infrastructure Damage: Increased flood risks make roads, bridges, and urban areas more vulnerable.

- Sikkim faces moderate risk, as it depends on tributaries of the Brahmaputra, including the Teesta River, which could be affected by China’s upstream water management. Though not directly on the Brahmaputra, Chinese water diversion projects could impact Sikkim’s river networks. If China diverts water from Tibetan rivers feeding into Sikkim, it could impact the Teesta and Rangit rivers. Many of Sikkim’s rivers are fed by Himalayan glaciers, which are melting due to climate change. Chinese dams could exacerbate water shortages in dry seasons. Sikkim has multiple hydropower projects on the Teesta, which could suffer from erratic water flow.

- Himachal Pradesh faces a more minor, indirect risk because the Sutlej River, which originates in Tibet, flows into it. Chinese dam-building on the upper Sutlej could reduce water flow into the state. India has reported fluctuations in the Sutlej’s water levels, which could be linked to upstream Chinese activity. Reduced Sutlej flow could affect irrigation and hydropower projects. Farmers and hydropower plants depend on steady river flow, which could be disrupted. Unlike Assam or Arunachal Pradesh, Himachal Pradesh faces a long-term risk rather than an immediate crisis.

- Ladakh faces a lesser-known, potentially serious threat, as the Indus River, which originates in Tibet, flows into Ladakh. Chinese upstream projects could impact the Indus water flow, affecting Ladakh’s water availability. China has previously explored diverting Tibetan rivers to supply its drier northern provinces. Ladakh is an arid region, and any reduction in Indus water could harm local farming.

- Arunachal Pradesh and Assam are the most threatened, with risks of floods, water shortages, and geopolitical disputes.

- Sikkim and Himachal Pradesh face indirect threats, mainly related to water flow disruptions.

- Ladakh could become a flashpoint, especially if China diverts the Indus tributaries.

-

-

5: Is ‘Dam for a dam’ the only way out between India and China?

-

-

- A “dam for a dam” strategy, where India builds its dams to counter Chinese upstream projects, is not the only way to address the water security threats posed by China’s control over trans-border Rivers. While building dams can provide some leverage, it is neither a long-term solution nor a risk-free strategy.

- Excessive dam-building could worsen floods by altering natural river flow. The Northeast is a seismically active zone, and excessive dam construction increases the risk of earthquakes and landslides.

-

6: What are your recommendations for India to counter China’s dam Aggression?

-

-

- India must adopt a multi-pronged approach that includes diplomacy, technological advancements, international cooperation, and legal mechanisms.

- Diplomatic engagement should try to reach a water-sharing agreement. India must push for bilateral negotiations on water flow guarantees, especially for the Brahmaputra. A possible framework could include year-round data sharing on water flows, a dispute resolution mechanism, and prohibitions on unilateral water diversion projects.

- India should resort to technological and intelligence-based monitoring, using satellites, drones, and AI-based hydrological models to track Chinese dam activity in Tibet. Early warning systems could help predict and mitigate sudden water releases or drought-like conditions. Sensor networks along Indian rivers could provide real-time data on water levels, quality, and possible upstream activity.

- India must work with Bangladesh, Bhutan, and Nepal, which depend on trans-border rivers. A joint water-sharing agreement with downstream countries can increase diplomatic pressure on China. India can engage global institutions like the UN Water Conference and Indo-Pacific Alliances (QUAD) to raise concerns over China’s water militarisation.

- India could take the “China Dam Issue” to international forums such as the International Court of Justice (ICJ) (though China is unlikely to comply), UNESCO, and the Mekong River Commission (as precedents for cross-border river management). India can also push for a South Asian Water Treaty, similar to the Mekong region’s agreements.

- Developing India’s water infrastructure, such as innovative water storage projects that can absorb excess water from floods and small-scale hydropower projects that reduce risk while ensuring water security.

- Instead of relying on a reactionary “dam for a dam” approach, India should pursue a balanced mix of diplomacy, surveillance, legal pressure, and selective dam-building.

- While building some dams is necessary, it should be part of a broader water security strategy.

-

Please Do Comment.

For regular updates, please register your email here:-

References and credits

To all the online sites and channels.

Pics Courtesy: Internet

Disclaimer:

Information and data included in the blog are for educational & non-commercial purposes only and have been carefully adapted, excerpted, or edited from reliable and accurate sources. All copyrighted material belongs to respective owners and is provided only for wider dissemination.